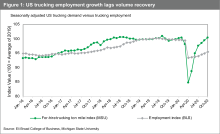

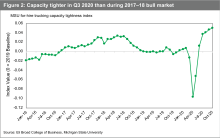

2020 saw the most pronounced swing in trucking capacity in recent memory. The broad shutdown of economic activity in April and May caused trucking demand, as measured by Michigan State University’s For-Hire Truck Ton-Mile Index, to decline far more than trucking employment, as measured by the Bureau of Labor Statistics, on a percentage basis, creating a capacity glut. As lockdowns lifted, demand for truck transportation rebounded more rapidly than trucking employment (see Figure 1), resulting in a level of capacity tightness that has equaled or exceeded the bull market of late 2017 through summer 2018 (see Figure 2). This capacity tightness has resulted in record spot market prices (as measured by DAT Solutions). Data as of mid-November suggest capacity tightness has reached peak levels, which should dampen further upward movement of spot market prices.

Click to enlarge

Click to enlarge

For shippers planning for 2021, it is crucial to recognize that tight capacity in 2020 has a different cause than in 2017–2018. The 2017–2018 bull market was driven by strong demand outstripping the pace at which carriers could add capacity, whereas tight capacity in 2020 was primarily the result of supply not returning once initial lockdowns lifted. As carriers rebalanced their freight networks to accommodate shippers whose demand soared due to COVID‑19, tender rejections were expected to abate, a dynamic that will be reinforced by contract rates adjusting upwards due to very high spot prices. Widespread vaccine distribution in late spring and summer is likely to cause consumers to transition away from goods to services. As durable goods manufacturing is down substantially relative to a year ago, per data from the Federal Reserve, and is unlikely to rebound quickly following vaccine distribution, this suggests capacity conditions for shippers will improve by mid-2021.